7dvd.ru Tools

Tools

Assets You Should Buy

Both technology and communication services are capital-light businesses, so, theoretically, they should be inflation winners. If you wish to invest in the S&P. assets. Important Information: Franklin Ethereum ETF (the "Fund") has filed a Before you invest, you should read the prospectus in the registration. Cars. A home. A rental property. Fine jewelry. Investments. An art collection. These are all assets that can increase your net worth. Assets don't count for renewals, which is why you don't need to report them. • In , renewal forms will no longer ask for asset information. • That. For a successful business, you should ideally own a What are assets? Asset management resources. Also on this site. Decide whether to lease or buy assets. Or saving for retirement or a future major purchase? Time horizon: when do you want to spend the money? Risk tolerance: how much money could you stand to lose? Six of the Best Assets to Inherit · 1. Cash · 2. Cash substitutes · 3. Brokerage accounts · 4. Assets that quickly decrease in value · 5. Roth IRA · 6. Assets in a. Stocks are often a riskier investment than bonds, but they also have the potential to generate higher returns. Bonds. When you buy a bond, you're loaning money. What to invest in right now · 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit . Both technology and communication services are capital-light businesses, so, theoretically, they should be inflation winners. If you wish to invest in the S&P. assets. Important Information: Franklin Ethereum ETF (the "Fund") has filed a Before you invest, you should read the prospectus in the registration. Cars. A home. A rental property. Fine jewelry. Investments. An art collection. These are all assets that can increase your net worth. Assets don't count for renewals, which is why you don't need to report them. • In , renewal forms will no longer ask for asset information. • That. For a successful business, you should ideally own a What are assets? Asset management resources. Also on this site. Decide whether to lease or buy assets. Or saving for retirement or a future major purchase? Time horizon: when do you want to spend the money? Risk tolerance: how much money could you stand to lose? Six of the Best Assets to Inherit · 1. Cash · 2. Cash substitutes · 3. Brokerage accounts · 4. Assets that quickly decrease in value · 5. Roth IRA · 6. Assets in a. Stocks are often a riskier investment than bonds, but they also have the potential to generate higher returns. Bonds. When you buy a bond, you're loaning money. What to invest in right now · 1. Stocks · 2. Exchange-traded funds (ETFs) · 3. Mutual funds · 4. Bonds · 5. High-yield savings accounts · 6. Certificates of deposit .

For example, you may invest more heavily in cash or cash equivalents in your down payment fund if you're getting ready to buy a house, while simultaneously. Asset class - Securities with similar features. The most common asset classes are stocks, bonds and cash equivalents. Average maturity - For a bond fund, the. One situation where extra cash may make more sense is if you're planning on a big purchase or expense within the next few years, such as buying a home, paying. While the SEC cannot recommend any particular investment product, you should know that a vast array of investment products exists - including stocks and stock. Overview: Best investments in · 1. High-yield savings accounts · 2. Long-term certificates of deposit · 3. Long-term corporate bond funds · 4. Dividend stock. Liquid assets like cash, stocks, and most bonds can be quickly converted to cash with minimal impact to their value, while non-liquid assets like real estate. Even if you don't qualify for Medicaid based on income, you should apply. If my income's too high for Medicaid, can I buy insurance through the Marketplace? By including asset categories with investment returns that move up and down under different market conditions within a portfolio, an investor can help protect. This material is provided for informational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. What is a high-risk, high-return investment? · Cryptoassets (also known as cryptos) · Mini-bonds (sometimes called high interest return bonds) · Land banking. “Ideally, you'll invest somewhere around 15%–25% of your post-tax income,” says Mark Henry, founder and CEO at Alloy Wealth Management. “If you need to start. My pick for a starter investment would be index funds or ETFs. It is quite easy to set up an account with a company like Vanguard. If you really. Buying stocks comes with what's called "equity exposure," the risk that the shares you own could fall in value or become worthless. This could be due to a. Non-liquid assets are familiar to business owners and consumers alike. To get a business up and running, you'll rent, lease, or purchase non-liquid assets by. If you're calculating your net worth, you should tally your assets first. This material is not a recommendation to buy, sell, hold, or rollover any. If you use the funds to purchase investments that generate taxable income—including interest, nonqualified dividends, and short-term capital gains—you may be. Pressing enter in the search box will also bring you to search results. Capital expenditures means expenditures to acquire capital assets or expenditures to. you must maintain separate records for the assets of each series. See If you have questions about whether you should form a series LLC, or a. Asset allocation: This refers to how you divide up your portfolio among different asset classes, such as stocks, bonds, and cash alternatives, to help you work. Why is investing important? Investing is an effective way to put your money to work and potentially build wealth. Smart investing may allow your money to.

Closing Costs On 400k Home

The major costs of selling a house (or seller closing costs) include the real estate commissions, legal fees, and sales tax on real estate commissions. Buyer closing costs are real estate transaction fees that are paid in addition to your down payment and mortgage amount - including taxes, title insurance. Use this calculator to determine how much you should expect to pay in closing costs on your home loan. That means if you take out a mortgage worth $,, you can expect closing costs to be about $12,–$24, The specific closing costs you'll need to pay in. They add up to between 2% and 5% for the buyer and 6% and 10% for the seller. That's a significant cost to factor in when buying a home. Read on for the most. A mistake that buyers often make is that when calculating the price and affordability of their future home, they do not take into account the closing costs that. A mistake that buyers often make is that when calculating the price and affordability of their future home, they do not take into account the closing costs that. The minimum down payment is $12, (3%). You should count on closing costs of about $10, including title, escrow, appraisal and deposits for. Money paid toward the purchase of a home, typically ranging between 5% and 20% of the purchase price. A down payment of less than 20% often requires the. The major costs of selling a house (or seller closing costs) include the real estate commissions, legal fees, and sales tax on real estate commissions. Buyer closing costs are real estate transaction fees that are paid in addition to your down payment and mortgage amount - including taxes, title insurance. Use this calculator to determine how much you should expect to pay in closing costs on your home loan. That means if you take out a mortgage worth $,, you can expect closing costs to be about $12,–$24, The specific closing costs you'll need to pay in. They add up to between 2% and 5% for the buyer and 6% and 10% for the seller. That's a significant cost to factor in when buying a home. Read on for the most. A mistake that buyers often make is that when calculating the price and affordability of their future home, they do not take into account the closing costs that. A mistake that buyers often make is that when calculating the price and affordability of their future home, they do not take into account the closing costs that. The minimum down payment is $12, (3%). You should count on closing costs of about $10, including title, escrow, appraisal and deposits for. Money paid toward the purchase of a home, typically ranging between 5% and 20% of the purchase price. A down payment of less than 20% often requires the.

In the United States average closing costs for homeowners are about $3,, though that depends heavily on home price and location. ClosingCorp averaged. How do you calculate closing costs on a house? How do I lower closing costs? Closing costs for buyer vs. seller. More mortgage calculators. What are closing. That means if you take out a mortgage worth $,, you can expect closing costs to be about $12,–$24, The specific closing costs you'll need to pay in. If you buy a property in that range, expect to pay between $6, and $14, in closing costs after taxes. Percentage of closing cost to home sale. Most experts estimate that the average closing costs on a house are around % to 2% of the home's value. How do I reduce closing costs? How much are closing costs? Closing costs are typically 2% to 4% of the loan amount. They vary depending on the value of the home, loan terms and property. If you buy a property in that range, expect to pay between $2, and $8, in closing costs after taxes. Data, Value. Average home sale price, $, Closing costs are the fees paid by a buyer and a seller at the time of closing on a real estate transaction. · A buyer usually pays 3% to 6% of the home sale. They add up to between 2% and 5% for the buyer and 6% and 10% for the seller. That's a significant cost to factor in when buying a home. Read on for the most. Seller closing costs can range from 8% to 10% of the home selling price. On a $, home, this can be between $40, and $50, in closing costs. Although. Use SmartAsset's award-winning calculator to figure out your closing costs when buying a home. We use local tax and fee data to find you savings. This refers to a range of fees and charges you pay — typically between 2% and 5% of the sales price — when you buy the home. The good news is that by estimating. In Georgia, the average closing cost amount is $3, for a $, mortgage. That is just slightly more than 1% of the loan amount and a fair amount less than. Closing costs usually range from 2% to 5% of the price of your mortgage loan amount. For example, if you buy a $, home with 10 percent down ($10,) and. Sellers can expect to pay around 6–10% of the home's purchase price (including real estate agent commissions). So, if you're selling a house, don't think you're. Closing costs can vary a lot by state and loan type. General rule of thumb from your lender is correct. 5% or so of loan size. You won't know. Your total estimated refinancing costs will be: $6, · Loan Info · Choose a term length · Taxes & Insurance · Origination Fees · Other Settlement Services. The origination fee related to the mortgage can get up to 1% to % of the total estimated buyer closing costs. Also, closing costs may vary depending on the. Typical closing costs and pre-paid expenses for NJ home buyers are 2% to 5% of the purchase price. The finalized amount of closing costs a buyer pays in New. Use this calculator to quickly estimate the closing costs on your FHA home loan. Get Current FHA Loan Rates.

Refinance Car Banks

How to refinance a car loan in 5 steps · 1. Decide if refinancing makes sense for you · 2. Check your credit · 3. Gather relevant documents · 4. Ask the right. Let us take the current auto loan you have financed elsewhere, lower the rate, and shrink your monthly payment to a more affordable size! Auto Credit Express - Refinance loan · MyAutoloan - Refinance loan · RateGenius - Refinance loan · Caribou - Refinance loan · Consumers Credit Union - Refinance. Car refinancing from another institution to RBFCU can be a great way to save on the vehicle you already own. Use our auto refinance calculator to find the. Apply online today to refinance your existing auto loan and you may be able to lower your monthly payments. An auto refinance with Old National: You may be able to lower your monthly auto loan payment or reduce your interest costs. Apply today! No impact to your credit score to see if you pre-qualify. Refinance your car with an easy online process and see if you could save monthly or overall. Refinancing a car can help you save money by lowering your interest rate, decreasing your monthly payment or allowing you to pay off your car loan sooner. At. Refi rates as low as % APR 1 for new vehicles. Plus, you could get a $ bonus when you refinance your auto loan from another lender. How to refinance a car loan in 5 steps · 1. Decide if refinancing makes sense for you · 2. Check your credit · 3. Gather relevant documents · 4. Ask the right. Let us take the current auto loan you have financed elsewhere, lower the rate, and shrink your monthly payment to a more affordable size! Auto Credit Express - Refinance loan · MyAutoloan - Refinance loan · RateGenius - Refinance loan · Caribou - Refinance loan · Consumers Credit Union - Refinance. Car refinancing from another institution to RBFCU can be a great way to save on the vehicle you already own. Use our auto refinance calculator to find the. Apply online today to refinance your existing auto loan and you may be able to lower your monthly payments. An auto refinance with Old National: You may be able to lower your monthly auto loan payment or reduce your interest costs. Apply today! No impact to your credit score to see if you pre-qualify. Refinance your car with an easy online process and see if you could save monthly or overall. Refinancing a car can help you save money by lowering your interest rate, decreasing your monthly payment or allowing you to pay off your car loan sooner. At. Refi rates as low as % APR 1 for new vehicles. Plus, you could get a $ bonus when you refinance your auto loan from another lender.

How LendingClub Bank Auto Refinancing Works · Check Your Rate. Tell us a little about yourself and your vehicle, and, if you qualify, you'll receive multiple. You can apply for an auto loan refinance with U.S. Bank online or by visiting your nearest branch. In most cases, you'll receive a decision on your application. When you refinance with Addition Financial, we'll work to lower your monthly payments or save you money on interest. Refinance your auto loan and lower your rates. Get pre-qualified online in minutes, with no impact on your credit score. Find out how much you could save! Calculate your potential auto refinance savings. Use this auto refinance calculator to compare your current loan with a refinance loan. With auto loan refinancing from PNC, you can refinance a car loan at a lower interest rate. Learn how it works and apply online today! If you love your car, but not your loan, refinancing with DCU could put you back in the driver's seat with lower rates and flexible terms. Refinance your auto loan to lower your interest rate, change your monthly payments or pay off your loan sooner. Apply to refinance with U.S. Bank and you. Refinancing your car can be worth it, since it may give you a lower rate or payment or a shorter loan term. Upstart's refinancing model looks beyond your credit. Looking to lower your auto loan payment? Refinance your auto loan with MECU in Baltimore, MD and enjoy great loan rates and lower monthly car payments. Refinancing your vehicle with Ally could help lower your monthly payment. Find out in minutes if you pre-qualify with no impact to your credit score. Want to refinance your car loan? Compare rates from top lenders, use our calculator to find your monthly payment and see exactly how much you can save. When you refinance an auto loan, you take out a new loan from a refinancing lender for the amount of your existing debt. The lender pays off your current. Compare auto loan refinance lenders in August ; Caribou, %%, Not specified ; Upstart, %%, 24 to 84 months ; RefiJet, %%, 24 to. Apply for a Fifth Third auto loan today and enjoy benefits like flexible repayment terms for new and used vehicles. Refinancing options are also available. We reviewed the best auto refinance loans on the market so you can find the best possible rates. Start saving money on your auto loan today. Auto Refinance Loan Benefits: Average payment savings of $ per month. Get the payment amount that suits your needs. Why Refinance Your Auto Loan? As you're working toward paying off your existing auto loan, there are reasons why you might want to consider refinancing. You have refinancing options. Consider the following questions when determining whether it makes financial sense to refinance your car loan. We have an auto loan that will work for you with competitive rates, a variety of terms to choose from and fast credit decisions.

Luna Coin News Today

August 25, - Discover the latest Terra USD price with real-time charts, market cap, and news. Learn about current trading trends and historical data. - The live price of Terra is $ per (LUNA/USD). View Terra live charts, LUNA market information, and LUNA news. Get the latest Terra (LUNA) cryptocurrency news, including LUNA coin price and breaking news on LUNA tokens from the Terra crypto blockchain project. The host of popular crypto analysis and market commentary show Coin Bureau says that $LUNA — the native token of algorithmic stablecoin platform Terra — could. Access real-time LUNC to USD rates and explore today's Terra Luna XRP And Three Other Altcoins To Stack Before 'New Altcoin Season' · LUNC+ While Luna's past has been marked by significant challenges, particularly the Terra Luna Classic collapse, there are positive developments and potential future. TERRA LUNA. Crypto Price Today: Bitcoin falls below above $42,; Cardano, Chainlink shed over 6% Crypto Price Today. Luna USD Price Today - discover how much 1 LUNA is worth in USD with Bitcoin, Ethereum, and other cryptocurrencies. bulb icon. To check 's price. The live Terra price today is $ USD with a hour trading volume of $87,, USD. We update our LUNA to USD price in real-time. Terra is down %. August 25, - Discover the latest Terra USD price with real-time charts, market cap, and news. Learn about current trading trends and historical data. - The live price of Terra is $ per (LUNA/USD). View Terra live charts, LUNA market information, and LUNA news. Get the latest Terra (LUNA) cryptocurrency news, including LUNA coin price and breaking news on LUNA tokens from the Terra crypto blockchain project. The host of popular crypto analysis and market commentary show Coin Bureau says that $LUNA — the native token of algorithmic stablecoin platform Terra — could. Access real-time LUNC to USD rates and explore today's Terra Luna XRP And Three Other Altcoins To Stack Before 'New Altcoin Season' · LUNC+ While Luna's past has been marked by significant challenges, particularly the Terra Luna Classic collapse, there are positive developments and potential future. TERRA LUNA. Crypto Price Today: Bitcoin falls below above $42,; Cardano, Chainlink shed over 6% Crypto Price Today. Luna USD Price Today - discover how much 1 LUNA is worth in USD with Bitcoin, Ethereum, and other cryptocurrencies. bulb icon. To check 's price. The live Terra price today is $ USD with a hour trading volume of $87,, USD. We update our LUNA to USD price in real-time. Terra is down %.

South Korea's attempts to extradite the founder of the collapsed Terra-Luna stablecoin will remain hamstrung while the courts in Seoul dispute the charges. Luna Coin (LUNA) is currently the # cryptocurrency by market cap at $2M USD. Trading volume for Luna Coin over the last 24 hours is $k USD. There have. Dexview / pancakeswap / biswap / babydogeswap This is a BSC coin meaning cheap transactions. Be part of something extraordinary. News. Upvote 7. Downvote 3. With a circulating supply of ,, LUNA, the market cap of Terra is currently M USD, marking a --% increase today. Terra currently ranks # in. Terra (LUNA) News Today: Get the latest updates news on Terra (LUNA), breaking news, & Important stories. Explore LUNA photos and videos on CoinGape. The current price of Luna / TetherUS (LUNA) is USDT — it has risen % in the past 24 hours. Try placing this info into the context by checking out. - LUNA real-time live price is USD current market cap of $- USD. Follow Terra,Luna Token,Terra Core,Luna Coin price, trends and news on. Terra Classic currently has a circulating supply of T and a market cap of $M. After the launch of “Terra 2,” the native token of the new network. Browse the latest news about Luna Coin from multiple news outlets and get the latest information for your Luna Coin research. TerraLUNA Live Terra price updates and the latest Terra news. The live Terra price today is $ with a hour trading volume of $M. The table above. Terra Luna Classic (LUNC) price has declined today. The price of Terra Luna Classic (LUNC) is $ today with a hour trading. The Terra chain has resumed block production at approximately AM UTC today and the chain upgrade is now complete. Transactions are now being processed. The current price is $ per LUNA with a hour trading volume of $M. Currently, Terra is valued at % below its all time high of $ This all-. LUNC Forecasts & News · Terraform Labs Faces Crucial Chapter 11 Hearing on September 19 amid Bankruptcy Crisis · Terraform Labs' Bankruptcy Hearing Sparks LUNA. Luna Classic (LUNC) Crypto News Today The original Terra blockchain became Terra Classic, with its asset called Luna Classic (LUNC). TerraUSD also became. The current ranking of luna crypto on the CoinMarketCap index is #82, with a market capitalization of $,, USD. It is available for purchase and sale on. The circulating supply of Terra Classic is 5,,,, LUNA and the current Terra Classic market cap is $,, 5,,, LUNA was purchased. Read the latest Terra news today and find out what's the trending LUNA news from the past week. On May 28, , the genesis block of the new chain was launched to conduct future transactions under the name Terra (LUNA), and the original Terra Chain was. Despite the initial goal, at its launch, the new Terra price did not come anywhere close to Terra Classic's peak of $, which was logged in April , weeks.

Va Loan Friendly Banks

Learn more about VA mortgages and how with a VA home loan from U.S. Bank, eligible veterans can buy a home with little or no down payment. At Gate City Bank, we're proud to stand with you, our nation's brave service members, offering the very best in VA loans, special offers, career opportunities. Best VA Mortgage Lenders of · What Are the Best VA Loan Lenders? · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City. VA Loans are government-backed year mortgages for purchasing or refinancing a home. This special military benefit is offered only to active-duty military. VA Home Loans are provided by private lenders, such as banks and mortgage companies, and VA guarantees a portion of the loan, enabling the lender to provide. PenFed Credit Union. Known for competitive rates, PenFed Credit Union could help save you money on interest payments over your loan term. They're very popular. Main pillars of the VA home loan benefit · No downpayment required · Competitively low interest rates · Limited closing costs · No need for Private Mortgage. Qualified applicants can finance up to % of their home's purchase price and benefit from many other friendly mortgage loan terms. Try Flagstar bank. I used them back in and got a very good rate. Not sure how that translates to this market but they offered a better VA. Learn more about VA mortgages and how with a VA home loan from U.S. Bank, eligible veterans can buy a home with little or no down payment. At Gate City Bank, we're proud to stand with you, our nation's brave service members, offering the very best in VA loans, special offers, career opportunities. Best VA Mortgage Lenders of · What Are the Best VA Loan Lenders? · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City. VA Loans are government-backed year mortgages for purchasing or refinancing a home. This special military benefit is offered only to active-duty military. VA Home Loans are provided by private lenders, such as banks and mortgage companies, and VA guarantees a portion of the loan, enabling the lender to provide. PenFed Credit Union. Known for competitive rates, PenFed Credit Union could help save you money on interest payments over your loan term. They're very popular. Main pillars of the VA home loan benefit · No downpayment required · Competitively low interest rates · Limited closing costs · No need for Private Mortgage. Qualified applicants can finance up to % of their home's purchase price and benefit from many other friendly mortgage loan terms. Try Flagstar bank. I used them back in and got a very good rate. Not sure how that translates to this market but they offered a better VA.

VA Mortgage Benefits Private lenders (mortgage companies and banks) are the ones who provide VA home loans. However, if eligible, you can get more favorable. Huntington offers Department of Veterans Affairs (VA) loans. And as a thank you to our veterans and servicemenbers, we provide assistance with closing costs. Freedom Bank of Virginia is a local, full-service community bank with experienced banking professionals, industry expertise, and innovative technology to. The Federal Home Loan Banks (FHLBanks, or FHLBank System) are 11 U.S. government-sponsored banks that provide liquidity to financial institutions to support. Best VA mortgage lenders · Bank of America: Best overall. · Better: Best for end-to-end service. · Veterans United: Best for loan options. · Navy Federal Credit. VA loans are available to active and veteran service personnel and their surviving spouses, and are backed by the federal government but issued through private. Explore VA Home Loan options with Brighton Bank, designed to help U.S. veterans, service members, & their spouses achieve homeownership. Learn about VA Home. For today, Saturday, September 14, , the national average year VA mortgage interest rate is %, down compared to last week's of %. The national. Everything from opening an account, securing a home loan or getting advice on the best banking options, we're here for you. In a fast-paced world, you can. 1. Not-For-Profit Organizations. Unlike traditional banks, credit unions are not-for-profit organizations. · 2. The Best Rates in Town · 3. Fewer Fees for. Neither VA nor AMBA endorses any particular banks, credit unions, products or services, or requires Veterans or other beneficiaries to use them. Our. Currently, you can have your VA benefits deposited into any bank or credit union account via Electronic Funds Transfer (EFT), deposited on a Direct Express. Top Banks for VA Loans · Veterans United Home Loans · USAA · Navy Federal Credit Union · Quicken Loans · PenFed Credit Union · Wells Fargo. Wells Fargo provides. Personalized in-person support from our financial experts and reliable online and mobile banking put you in control. Fremont Bank offers best-in-class rates on mortgages, refinance and home equity lines of credit. Check out our rates and contact us today for more. Credit Unions & Best Banks for Military & Veterans · Best overall military bank – USAA · Best for extra military benefits – Bank of America, US Bank Military. Huntington offers Department of Veterans Affairs (VA) loans. And as a thank you to our veterans and servicemenbers, we provide assistance with closing costs. Up to % financing is available for loans, which are guaranteed by the U.S. Department of Veteran Affairs. VA loans can be used for purchases and refinances. Why Choose a VA Loan? All Veterans deserve a place on American soil to call their own. With a 0% down payment, that dream could become a reality sooner than. PenFed Credit Union. Known for competitive rates, PenFed Credit Union could help save you money on interest payments over your loan term. They're very popular.

Investment Volume

Investor Relations. Volume Statistics. Facebook · Twitter · Email; Tumblr; LinkedIn · News & Events · Stock · Financials · Governance · ESG · Resources. Through a combination of record investment volumes and groundbreaking innovations in the investment space, the mobilization of private capital has had a clear. Trading volume can help traders confirm or refute trading trends. Learn how traders can use trading volume as an indicator to potentially identify trends. While stock volume measures the total number of shares traded over a specified period, dollar volume represents the total value of the shares traded. For. Price-Volume Relationship refers to the relationship between price and volume, which is a rather important indicator in the stock market. The volume of a. Today's All US Exchanges Stock Volume Leaders: most actively traded stocks. Volume, or trading volume, is the amount (total number) of a security (or a given set of securities, or an entire market) that was traded during a given period. No statement in this web site is to be construed as a recommendation to purchase or sell a security, or to provide investment advice. Options involve risk and. Stock volume is the number of shares traded over a period of time (typically daily, weekly, and monthly). Investor Relations. Volume Statistics. Facebook · Twitter · Email; Tumblr; LinkedIn · News & Events · Stock · Financials · Governance · ESG · Resources. Through a combination of record investment volumes and groundbreaking innovations in the investment space, the mobilization of private capital has had a clear. Trading volume can help traders confirm or refute trading trends. Learn how traders can use trading volume as an indicator to potentially identify trends. While stock volume measures the total number of shares traded over a specified period, dollar volume represents the total value of the shares traded. For. Price-Volume Relationship refers to the relationship between price and volume, which is a rather important indicator in the stock market. The volume of a. Today's All US Exchanges Stock Volume Leaders: most actively traded stocks. Volume, or trading volume, is the amount (total number) of a security (or a given set of securities, or an entire market) that was traded during a given period. No statement in this web site is to be construed as a recommendation to purchase or sell a security, or to provide investment advice. Options involve risk and. Stock volume is the number of shares traded over a period of time (typically daily, weekly, and monthly).

First-quarter sales volume dropped 70% year-over-year across all four of the core sectors – Office, Industrial, Apartments and Retail – as property values. investment activity and asset prices over the medium term. Figure 7: U.S. Historical & Forecast Investment Volume, to Source: CBRE Research, MSCI. Low volume on falling prices indicates that few investors will reduce the price to secure a sell and that they are comfortable keeping the stock. This is. Unit Investment Trust (“UIT”) sponsors may pay Edward Jones additional compensation, sometimes called a “volume concession,” that is based on the overall. Volume is simply the number of shares traded in a particular stock or other investment over a specific period of time. Investor Contacts. Download the historical volume tables, current month volume press release and MKTX trading days. Current Month Volume Press Release here. Investment and refinancing opportunities. Identify potential investment opportunities by targeting properties that meet specific criteria such as by age, size. The Volume Percent Change compares the stock's trading volume from the previous day with the number of shares traded on an average daily basis over the last Stock volume is the total number of shares traded within a specified period of time, and thankfully computers calculate this for us. "Volume" represents the number of shares traded during a defined period, typically a day. You'll often see the full term spelled out, too. US CRE transaction volume continued to slide through Q2 Cumulative transaction volume across Q2 was the lowest volume ($) since Investment. Global Cross-Regional Investment Volume Nears Stability. Global Real Estate Capital Flows H1 August 28, 7 Minute Read. 7dvd.ru: The Volume Factor: The Missing Piece: Goals-Based Investment Strategies To Achieve Successful Investment Outcomes: Dormeier CMT. Focussing on Investment, this book provides an overview of rules applicable to making and protecting foreign investments. It will enable the business. Great Investment Ideas (Volume 9): Ziemba, William T: 7dvd.ru: Books. Volume of trade, also known as trading volume, refers to the quantity of shares or contracts that belong to a given security traded on a daily basis. Volume 2 - Nonimmigrants · Volume 3 - Humanitarian Protection and Parole investment opportunities, thereby reducing the immigrant investor's responsibility to. Cumulative transaction volume across Q2 was the lowest volume ($) since Investment activity, measured by non-distress single-asset transactions. Volume analysis refers to the examination of the total number of securities transacted within a given time period. They can be shares or contracts of any.

Year Fixed Mortgage Rates

Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Category: Interest Rates > Mortgage Rates, 32 economic data series, FRED Year Fixed Rate Conforming Mortgage Index: Loan-to-Value Less Than or. Year Fixed Rate. Interest%; APR%. More details for Year Fixed Rate. Year Fixed-Rate VA. Interest%; APR%. More details for Year Fixed. With a fixed rate mortgage loan from PNC Bank, you will have consistent payments for the life of your home loan. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Loan Options. All Home LoansYear FixedYear FixedAdjustable-Rate MortgageBorrowSmart AccessFHA LoanHomeReady® & Home Possible®Home Equity LoanJumbo. On Sunday, September 01, , the current average interest rate for a year fixed mortgage is %, down 11 basis points over the last seven days. For. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. Category: Interest Rates > Mortgage Rates, 32 economic data series, FRED Year Fixed Rate Conforming Mortgage Index: Loan-to-Value Less Than or. Year Fixed Rate. Interest%; APR%. More details for Year Fixed Rate. Year Fixed-Rate VA. Interest%; APR%. More details for Year Fixed. With a fixed rate mortgage loan from PNC Bank, you will have consistent payments for the life of your home loan. Conforming and Government LoansExpand Opens DialogExpand · Year Fixed Rate · Interest% · APR%. Know what the current mortgage interest rates are today, or get your own custom home mortgage rate. Compare 30 and 15 years fixed mortgage rates and more. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Loan Options. All Home LoansYear FixedYear FixedAdjustable-Rate MortgageBorrowSmart AccessFHA LoanHomeReady® & Home Possible®Home Equity LoanJumbo. On Sunday, September 01, , the current average interest rate for a year fixed mortgage is %, down 11 basis points over the last seven days. For.

Fannie Mae expects the average year fixed mortgage rate to trend slightly down between for Q3 and Q4 Fannie Mae forecasts the downward trend will. Year Fixed Mortgage Rates* ; , % ; , % ; , % ; , %. 30 Year Fixed CommunityWorks: The total repayment term for this fixed rate loan is 30 years or payments. Monthly principal and interest payments will be. For today, Thursday, September 12, , the current average interest rate for a year fixed mortgage is %, down 16 basis points from a week ago. If you'. Mortgage Rates Continue to Drop. August 29, Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue. Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February Rates continue to soften due to. Compare our current interest rates ; year fixed, %, %, ($), $ ; FHA loan, %, %, ($), $ 30 Yr. Fixed, %, , %. The current average year fixed mortgage rate climbed 2 basis points from % to % on Friday, Zillow announced. The year fixed mortgage rate on. year Fixed-Rate VA Loan: An interest rate of % (% APR) is for a cost of Point(s) ($5,) paid at closing. On a. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Mortgage rates: Current home interest rates. Please turn on JavaScript LOAN TYPE. 15 year Fixed. RATE. XXX. APR Footnote(Opens Overlay). XXX. LOAN TYPE. In a year fixed mortgage, your interest rate stays the same over the year period, assuming you continue to own the home during this period. These. A fixed-rate loan of $, for 30 years at % interest and % APR will have a monthly payment of $1, Taxes and insurance not included; therefore. 5/5 Conforming ARM Payment Example. Loan Amount: $, Term: 30 years. Today's Locked Mortgage Rates ; YR. CONFORMING. % − ; YR. CONFORMING. % − ; YR. JUMBO. % + ; YR. FHA. % − The rates shown above are the current rates for the purchase of a single-family primary residence based on a day lock period. Fixed-rate mortgages are a good choice if you: · Think interest rates could rise in the next few years and you want to keep the current rate · Plan to stay in. Fixed year mortgage rates in the United States averaged percent in the week ending August 23 of This page provides the latest reported value.

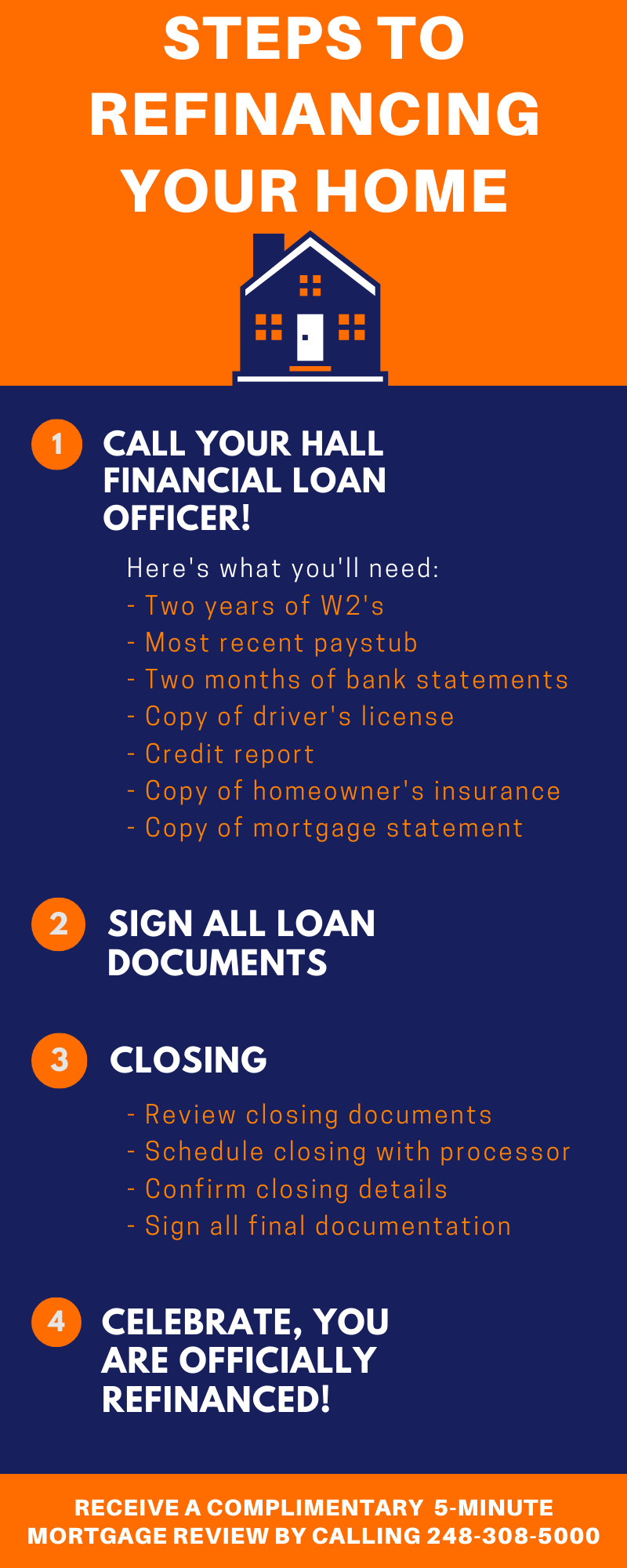

When Do You Refinance A Home

This guide explains when it's ideal to refinance your mortgage. It also discusses circumstances when holding off may be a more sound idea. It depends on your lender. Most won't refinance a mortgage they've issued within the last – days, in which case you'll need to look to another. I'd wait until Q3 next year. Try to pay as much of your principal as you can till then. Expect mortgage rates to dip below 6 by Q3 next yr. Refinancing can allow a borrower to get a better interest rate on their mortgage. Refinancing a house means you replace the mortgage you have with a new. Refinancing your mortgage basically means that you are trading in your old mortgage for a new one, and possibly a new balance. The answer may be "sooner than you think," although it depends on the refinance program you're looking for, the loan type, and if any penalties apply. Refinancing your mortgage may be a smart move if you're still in the early years of your mortgage and can get a lower interest rate by refinancing. How long do you have to wait before refinancing a mortgage? Your current lender might ask you to wait six months between loans, but you're free to simply. The timeline for refinancing will depend on your lender and the type of mortgage you have. Some mortgages allow you to refinance right away, while others. This guide explains when it's ideal to refinance your mortgage. It also discusses circumstances when holding off may be a more sound idea. It depends on your lender. Most won't refinance a mortgage they've issued within the last – days, in which case you'll need to look to another. I'd wait until Q3 next year. Try to pay as much of your principal as you can till then. Expect mortgage rates to dip below 6 by Q3 next yr. Refinancing can allow a borrower to get a better interest rate on their mortgage. Refinancing a house means you replace the mortgage you have with a new. Refinancing your mortgage basically means that you are trading in your old mortgage for a new one, and possibly a new balance. The answer may be "sooner than you think," although it depends on the refinance program you're looking for, the loan type, and if any penalties apply. Refinancing your mortgage may be a smart move if you're still in the early years of your mortgage and can get a lower interest rate by refinancing. How long do you have to wait before refinancing a mortgage? Your current lender might ask you to wait six months between loans, but you're free to simply. The timeline for refinancing will depend on your lender and the type of mortgage you have. Some mortgages allow you to refinance right away, while others.

Or to leverage the equity they already have. When you refinance a year loan to a year loan, you'll build equity twice as fast. This refinance strategy. The waiting period between taking out a mortgage and being eligible for a refinance varies by loan program. Some home loans qualify for refinancing right away. Refinancing a home is a big decision that depends on your financial situation, available interest rates and your long-term plans for staying in the home. · In. Reasons to refinance · 1. Lowering your mortgage rate. · 2. Moving from one mortgage product to another. · 3. Building equity faster. · 4. Getting cash out. Refinance is possible only if you have equity in your home. If you put in an offer on a house at your max budget of $k, but your house is. A lower interest rate is one of the best reasons to refinance your mortgage. This is because it means potentially reducing your monthly payment. Some mortgages allow a “cash-out” refinance, so you can turn some of your home equity into cash or use it to pay off high-cost debt. The money you take out will. When interest rates are going down it can be a good time to refinance. You can either keep your current loan term and lower your monthly payments, or you can. Refinancing your mortgage in simple terms is when you get a new loan for your existing home, and pay off your first loan. Mortgage refinances can help homeowners save money by lowering their monthly housing cost, or by reducing their interest rates and improving the terms of their. Many lenders will require at least a year of payments before refinancing your home. Some refuse to refinance in any situation within to days of issuing. When you refinance, you are applying for a new mortgage to replace your current one, which will result in a new rate, term and monthly payment. Refinancing is the process of paying off an existing mortgage loan with a new one. Generally speaking, if refinancing can save you money, help you build. There is usually no limit on how often you can refinance and no right or wrong number of times to refinance—just the number of times refinancing makes financial. Refinancing can potentially lower your monthly mortgage payment, pay off your mortgage faster or get cash out for that project you've been planning. Some borrowers can refinance immediately after closing on their original mortgage, while others may need to wait several months. Conventional loans. You can. Maybe you want to lower your monthly payment, change the loan term, get a lower interest rate, or tap into your home equity for other expenses. Refinance Your Mortgage and Save. Depending on the terms of your current loan and how long you plan to stay in your home, refinancing could be the best. There's no limit on the number of times you can refinance your mortgage. If it makes sense to refinance five different times, go for it. Just be sure to work. Generally, a mortgage refinance is a good idea if it will save you money. Mortgage experts say you should consider this move if you can lower your interest.

How Much Are The New Iphone 13

Shop the latest iPhone models and accessories. Save with Apple Trade In, carrier offers, and flexible monthly payment options. Get expert help today. Apple is now selling refurbished iPhone 13 Pro and iPhone 13 Pro Max devices via its official online store in the United States. This follows their initial. Get $50 - $ off iPhone 13 when you trade in an iPhone 7 Plus or newer. For many users, the Apple Watch is the perfect complement to an new Apple iPhone. With a stylish interface, you can receive alerts or updates and respond right. The most advanced dual-camera system ever on iPhone. Lightning-fast A15 Bionic chip. A big leap in battery life. Durable design. Superfast 5G. As of June , the iPhone 13 is the oldest iPhone model still officially sold by, and fully supported by Apple (the iPhone 13 Mini was discontinued on. GB · $ · $ ; GB · $ · $ ; GB · $ · $ Apple iPhone 13 Pro Max ; Retail Price, $ ; Before Monthly Credits, $/month ; After Monthly Bill Credits, $/month/month. The manufacturer's suggested retail price (MSRP) for the iPhone 13 started at $1, (CAD) for the GB model. What Factors Impact the Price of a Used iPhone. Shop the latest iPhone models and accessories. Save with Apple Trade In, carrier offers, and flexible monthly payment options. Get expert help today. Apple is now selling refurbished iPhone 13 Pro and iPhone 13 Pro Max devices via its official online store in the United States. This follows their initial. Get $50 - $ off iPhone 13 when you trade in an iPhone 7 Plus or newer. For many users, the Apple Watch is the perfect complement to an new Apple iPhone. With a stylish interface, you can receive alerts or updates and respond right. The most advanced dual-camera system ever on iPhone. Lightning-fast A15 Bionic chip. A big leap in battery life. Durable design. Superfast 5G. As of June , the iPhone 13 is the oldest iPhone model still officially sold by, and fully supported by Apple (the iPhone 13 Mini was discontinued on. GB · $ · $ ; GB · $ · $ ; GB · $ · $ Apple iPhone 13 Pro Max ; Retail Price, $ ; Before Monthly Credits, $/month ; After Monthly Bill Credits, $/month/month. The manufacturer's suggested retail price (MSRP) for the iPhone 13 started at $1, (CAD) for the GB model. What Factors Impact the Price of a Used iPhone.

iPhone 13 Mini, GB, Blue - Unlocked (Renewed) Only 1 left in stock.

iPhone 13 prices start at $ and cost $ on average as of September iPhone 13 prices will continue to get cheaper over time. Apple phones hold. Apple iPhone 13 This monthly payment estimate reflects 0% APR when paying over 24 months and may require a down payment. Full price: $ Want to pay in. The cost of the iPhone 13 is between R13, - R16, copy. With the launch of the iPhone 15, many are left wondering if it's still worth investing in the iPhone iPhone 13 will continue to receive support and new. Apple iPhone 13 Unlocked 5G speed A15 Bionic chip Dual-camera system Beautifully bright Super Retina XDR display Supports MagSafe accessories. Expert reviews and ratings · This year's key iPhone is no poor relation to the Pro – there's so much to love about it. · The iPhone 12 was a good phone. iPhone The most advanced dual-camera system ever on iPhone. Lightning-fast A15 Bionic chip. see more SIM Activate online with eSIM COLOR: Pink. iPhone 13 Pro Prices ; GB iPhone 13 Pro Gold, $, $0 ; GB iPhone 13 Pro Graphite, $, $0 ; GB iPhone 13 Pro Sierra Blue, $, $0 ; GB iPhone 13 Pro. How much can I sell my iPhone® 13 for? The price you can sell your Apple iPhone 13 for varies. Factors include storage capacity, wireless carrier, and. iPhone The most advanced dual-camera system ever on iPhone. Lightning-fast A15 Bionic chip. A big leap in battery life. Durable design. Superfast 5G. The iPhone 13 has a new wide camera and dual-camera system that gathers 47% more light, resulting in less noise and brighter pics with more detail. Buy the Apple iPhone 13 from AT&T. Featuring a inch Super Retina XDR display with 5G speed. Get the best Apple iPhone 13 deals at AT&T. iPhone Your new superpower. · Hearing Aid. M3/T4 · OS. iOS · Network. 5G LTE/Wi-Fi · Display. inch Super Retina XDR OLED, HDR10, Dolby Vision display. iPhone. Explore iPhone. Explore All iPhone · iPhone 15 Pro · iPhone 15 · iPhone 14 · iPhone 13 · iPhone SE · Compare iPhone · Switch from Android. Shop iPhone. Pre-Owned Apple iPhone 13 Pro Max GB GB GB GB All Colors - Factory Unlocked Cell Phones (Like New). out of 5 Stars. 3 reviews. Apple iPhone 13 - GB GB GB - All Colors - Excellent Condition · $ to $ Free shipping. 7 sold ; Apple iPhone 13 GB Factory Unlocked AT&T T. On select plans, trade-in required. Shop Now. iPhone 15 Pro Titanium facing left and showcasing its three big lenses. New line/new account, eligible. In many cases, selling a premium model like the iPhone 13 Pro Max will help pay for the down payment on the latest iPhone. How Much Is Your iPhone 13 Pro Max. Considering Apple introduced the iPhone 14 in and the iPhone 13 was reduced to just the plain and mini version, I expect in September of. Buy iPhone 13| iStore - The dedicated hub for all Apple products alongside the best Apple experience and exclusive services.

App To Track All Investments

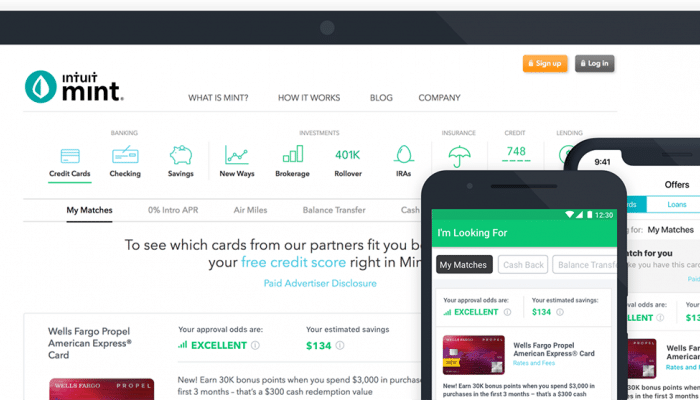

INDmoney is the first and last solution to track all investments in one place. No extra costs, and no more hassles in managing your money. Now that you are. “Capitally is an excellent tool that provides a complete overview of all our assets, including real-time stocks, real estate, and private equity. It saves us a. The #1 investment tracking app that helps you keep track of your crypto, stocks, ETFs, commodities, NFTs, and forex in one place by connecting your brokers. Gemini is well-suited for crypto traders of any skill level and available in all 50 states. Sign up and trade to get $10 in bitcoin. Open An Account. 3. Welcome To EquityStat · Manage All Of Your Financial Investments In One Place · Track The Performance Of Your Investments · View Your Investment Portfolio On All. Powerful portfolio tracking software that lets you check your investments in one place with award-winning performance, dividend tracking and tax reporting. The best portfolio trackers make it easy to visualize all your investments in one place and track performance and asset allocation across multiple accounts. Wealthica offers an aggregated and consolidated view of your entire investment portfolio, including stocks, ETFs, mutual funds, and other assets. This holistic. Some popular ones include Mint, Personal Capital, SigFig, and Robinhood. These apps typically allow you to link your investment accounts from. INDmoney is the first and last solution to track all investments in one place. No extra costs, and no more hassles in managing your money. Now that you are. “Capitally is an excellent tool that provides a complete overview of all our assets, including real-time stocks, real estate, and private equity. It saves us a. The #1 investment tracking app that helps you keep track of your crypto, stocks, ETFs, commodities, NFTs, and forex in one place by connecting your brokers. Gemini is well-suited for crypto traders of any skill level and available in all 50 states. Sign up and trade to get $10 in bitcoin. Open An Account. 3. Welcome To EquityStat · Manage All Of Your Financial Investments In One Place · Track The Performance Of Your Investments · View Your Investment Portfolio On All. Powerful portfolio tracking software that lets you check your investments in one place with award-winning performance, dividend tracking and tax reporting. The best portfolio trackers make it easy to visualize all your investments in one place and track performance and asset allocation across multiple accounts. Wealthica offers an aggregated and consolidated view of your entire investment portfolio, including stocks, ETFs, mutual funds, and other assets. This holistic. Some popular ones include Mint, Personal Capital, SigFig, and Robinhood. These apps typically allow you to link your investment accounts from.

If you have made several mutual fund investments and find it difficult to keep track of all, Groww mutual fund tracker can help you import all of external. Wealthica empowers investors to track their net worth and all their investments effortlessly in a single dashboard. Take full control over your investment. Acorns is a financial app that gives you access to a robo-advisor, IRAs and even a checking account. It made our list because it's a good choice for novice. MoneyPatrol provides a comprehensive suite of tools and features that cover all aspects of personal finance management. From expense tracking to budgeting to. Delta tracks all your assets in one place and provides you with the tools & charts you need. The best thing? It's free! ▸ Multi-Asset investment tracking. Leading online stock portfolio tracker & reporting tool for investors. Sharesight tracks stock prices, trades, dividends, performance and tax! Track your spending, investments, and net worth in the best-in-class app for Mac and iPhone. Playbook is like other robo-advisors and robo-advisor adjacent apps on this list, in that it charges a monthly flat fee for keeping track of your investments. Finary is the ultimate wealth management app. Track all your assets, get real-time performance reports, optimize your wealth and invest in crypto-currencies. Track All Your Investments in One Place Save time by monitoring your unit trusts & OEICs, investment trusts, pension funds, stocks and ETFs in one place. INDmoney: India's SuperMoneyApp All-in-one app to Track, Invest, and Grow your money - Trusted by Cr+ investors. Key features of the INDmoney App. INDmoney: India's Super Money App. All-in-one finance app to Track, invest & grow your money - Investment and Finance App with Cr+ trusted customers. Playbook is like other robo-advisors and robo-advisor adjacent apps on this list, in that it charges a monthly flat fee for keeping track of your investments. Delta is the ultimate stock & equity tracker app. Keep track of all stocks spanning global markets such as Nasdaq, NYSE, Euronext, HKEX, and more. Discover a seamless investment management experience through our app's intuitive interface. Monitor and manage your investments with ease, track multiple. Best investment apps to help you make money · Betterment – Best app for automated investing · Invstr – Best app for education · Acorns – Best app for saving. Empower is one of the biggest budgeting apps around. Their investment tracker is one of the most powerful on the market. Empower is all about charts and graphs. Tune-up your investments with the free portfolio analyzer · Check under the hood of your portfolio · A closer look at investment checkup · Make the most of your. Best net worth tracking app for stock and crypto investors: Kubera Kubera calls itself the “world's most modern net worth tracker,” which is certainly a large. Learn how to track your Investments on the Quicken Simplifi Mobile App. all accounts, or for individual investment accounts. You can select any of.